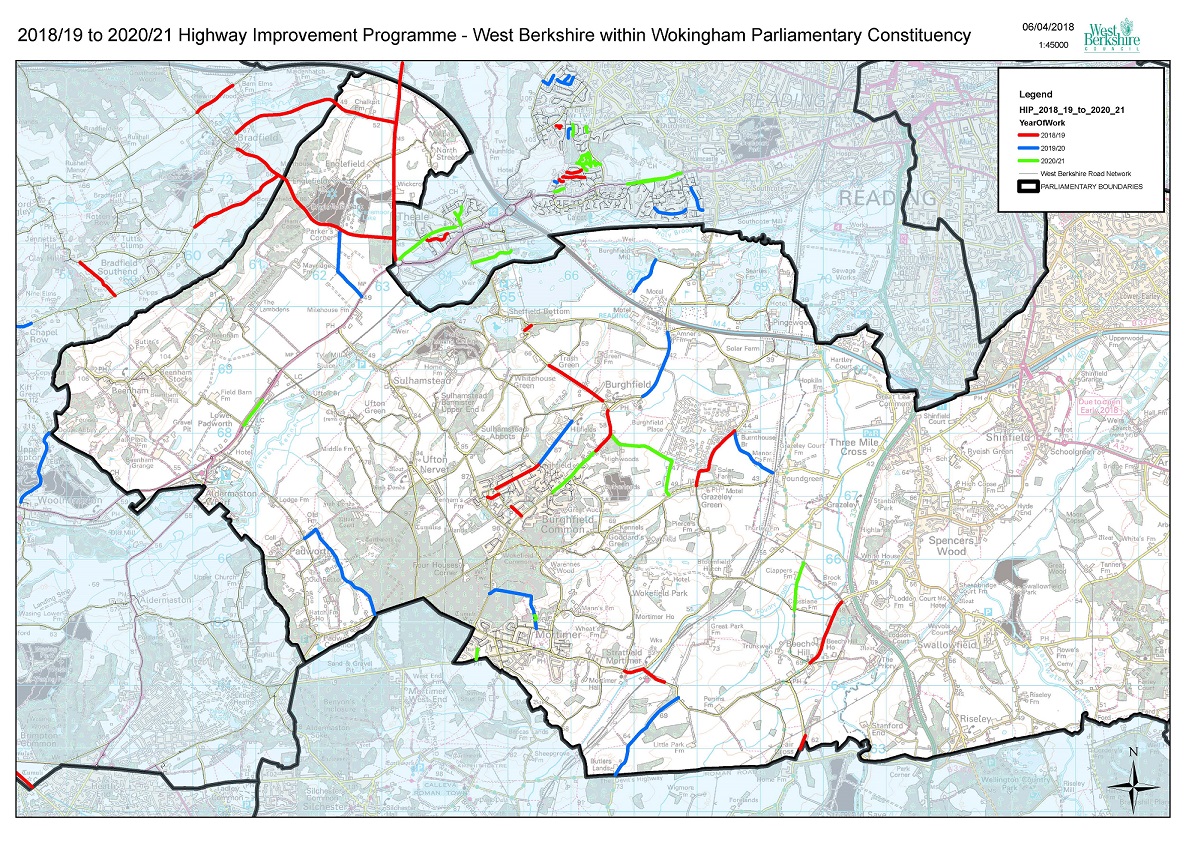

West Berkshire Council Pothole Repair Program

West Berkshire Council has provided me with a map of their pothole repair program. You can also access more information about this at: http://info.westberks.gov.uk/CHttpHandler.ashx?id=34805&p=0

How should the West respond to Syria

The NATO Allies are sure that the Syrian regime unleashed chemical weapons against the civilian population and rebel fighters. Russia denies it, and Inspectors may go in to see for themselves what evidence remains from the violence some days later. President Obama made the use of chemical ordnance a red line Assad should not cross, but then decided not to take action when he did. President Trump also made it a red line, and followed a previous case of presumed chemical weapon use with a single surgical strike. This has not deterred the latest incident.

The West is now seeking to establish good evidence of what it believes has taken place, and is considering its military options. These are limited and constrained by circumstance, and by the history of the West leaving much of the Syrian theatre to a combination of Assad and Russian power to deal with Isis. No-one can credibly claim that killing more Syrians is the missing policy in this dreadful conflict that could start to put things right. There have been all too many deaths already, and the West will not wish to add to the death toll of civilians. Taking on the Assad regime and its troops is an unlikely mission, as they are strong on the ground, battle hardened, and understand the people and the terrain. It would entail a huge effort by the West including an invasion. When tried elsewhere the problem has been how to create a replacement government that is stable, has authority and is democratic in such circumstances. Supporting the rebel forces against Assad with air power would be a dangerous mission pitting the West against Russia who would continue to support Assad. There is no evidence that there is a well armed and substantial rebel force with a chance of winning against Assad and Russia who could also create a stable and good government in the end.

This seems to leave Mr Trump with using missiles and smart bombs to destroy known military installations, weapons dumps and any chemical weapons facilities that they have identified. Even this will require great precision and care not to harm people who live near to these facilities, and to deal with any attempt by the regime to organise actual or fake damage to release as bad news following any attacks. Mr Trump may like to involve France and the UK in any such attack to show this is a wider Western alliance action, undertaken by three members of the UN Security Council. It cannot however be done in the name of the UN as Russia has vetoed a proposed resolution on this Syrian atrocity.

NATO needs to ensure that if it does fly missions by fast jets, or send in drones or missiles, it does so without creating a military exchange with Russia. The military airspace over Syria is often used by Syrian and Russian planes. Events can happen quickly when fast jets from Russia and NATO are seeking to use limited airspace for different purposes, and when the fast jets can close on each other with each flying at speeds well in excess of 1000 miles an hour.

What should the UK do? It should of course work with our NATO allies. With them we have condemned any use of chemical weapons, and with them we can examine the options. I also trust the UK will be a sane voice wanting us to act effectively where we can, rather than demanding action to reveal our anger even if there is no action that is likely to have a good outcome.

Is there any such thing as a pure nationalised service?

On Friday 27th April at 11 am in the Old Library at All Souls College, High Street Oxford I am giving an open lecture to answer this question.

I will examine the different ways the public and private sectors work together to deliver public services, and offer a new way of analysing services for their public and private sector components.

I will remind the audience that most of the UK railway is provided by the public sector, and a lot of our current health care both within and outside the NHS is delivered by the private sector. People value the free at the point of need main proposition of the NHS but worry less about who provided what within that. They accept drugs supplied by for profit companies retailed by private pharmacies and often prescribed by GPs working as independent contractors to the NHS. I will conclude that there is no such thing as a purely public sector service in a mixed economy like the UK, and argue that a lot of what the private sector does is also public service.

How lower taxes could help economic growth

Three recent posts have shown how the government has used higher taxes to stop or reduce activities that it does not approve, with considerable success. These policies have slowed the economy a bit as a result.

Given that the government knows how to do this, wouldn’t it be a good idea if it did more the other way, identifying how cutting taxes might stimulate more activity?

It does recognise that taxing work too much is a bad idea, and has been cutting the tax on work by removing more people from Income Tax altogether and raising the tax free allowance generally. This has been a helpful background to boosting employment, which has been rising steadily as Income Tax has been reduced by this method. The more that can be done to reduce the tax on work the better, as all political parties claim to believe that work is a good thing. If you want more work in any given country you need to ensure the tax rates on work are internationally competitive. The UK needs to revisit its rates in the light of the sweeping US tax cuts.

There are other examples where taxes have been raised on behaviour which the government says it favours. Most of these relate to entrepeneurship and saving. The government says it wants people to save so they have money for their old age and for any adverse event that may befall them. It says it wants to encourage more people to set up their own businesses and to venture their money to help establish and expand other people’s businesses.

If this is the case then why has the government hiked Stamp Duties? Why does it persist with a 28% Capital Gains Tax rate on property? Why has it cut pension tax reliefs?

Stamp Duties and Capital Gains tax are taxes people do not have to pay. They are easily avoided by doing nothing. Those in the fortunate position of having made past successful investments can sit on them. Those who aspire to own investments can be put off by the transaction taxes. People keep properties that may be too big for them or are no longer in the best place for them as they do not wish to pay the CGT on sale or the Stamp Duty on buying something more suitable. As we have seen Buy to let investment in new homes or conversions to provide more rented accommodation for others has been hit hard by higher taxes.

The government could and should do more to promote savings and enterprise. The best and most energetic can flourish, but we need a tax system which makes it easier for everyone, so the more marginal projects find cash and support.