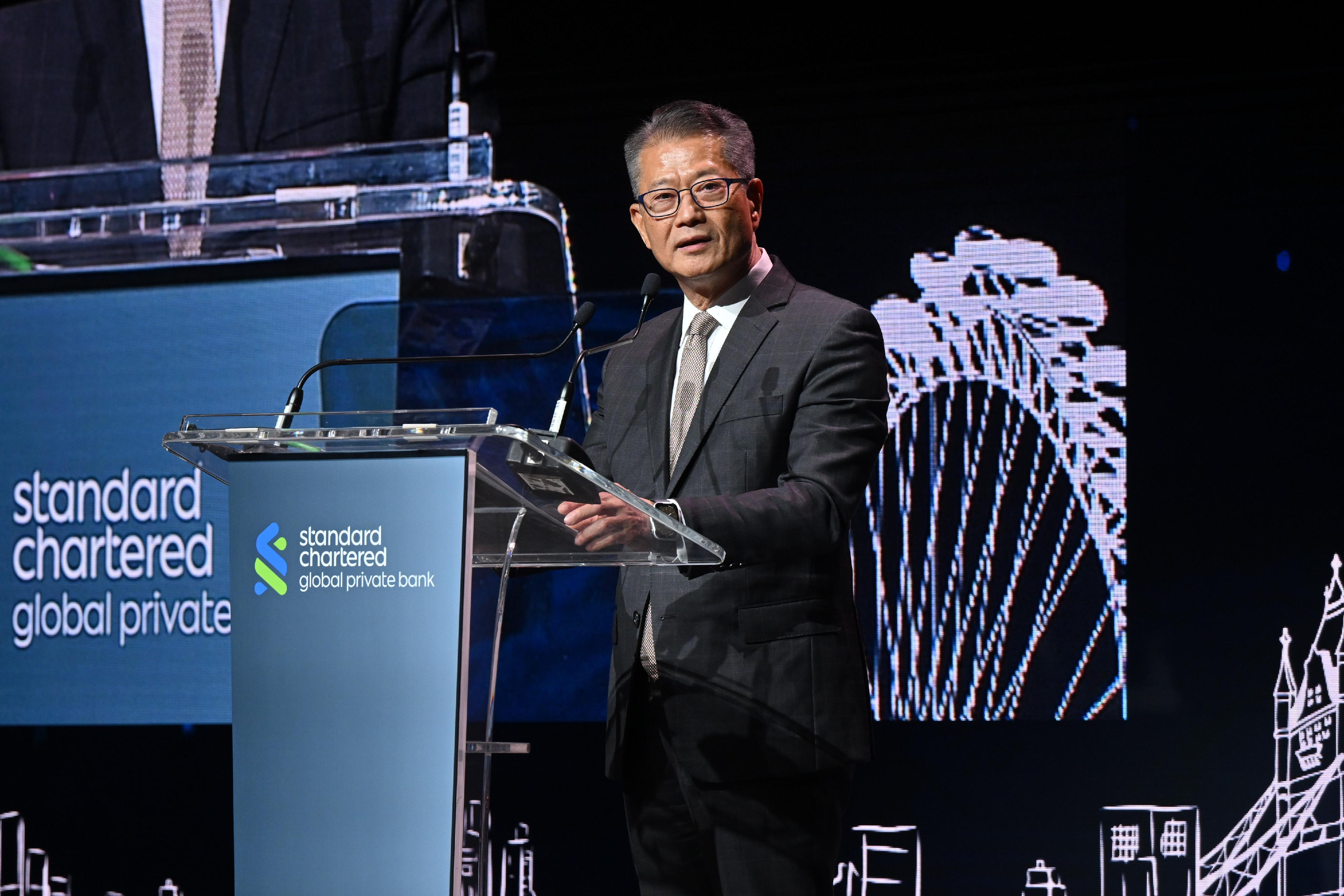

Following is the speech by the Financial Secretary, Mr Paul Chan, at the welcome dinner for the Standard Chartered Private Bank Global Family Network 2024 today (October 15):

Bill (Group Chief Executive, Standard Chartered, Mr Bill Winters), Ben (President, International, Standard Chartered, Mr Benjamin Hung), Mary (Chief Executive Officer, Hong Kong and Greater China & North Asia, Standard Chartered, Ms Mary Huen), distinguished guests, ladies and gentlemen,

Good evening. I am very pleased to join you all at this welcome dinner for Standard Chartered's inaugural flagship Global Family Network Forum, bringing together influential families from across Asia, the Middle East and Europe.

First of all, I wish to extend our warmest welcome to you all to Hong Kong. You've chosen a wonderful time to visit, with the perfect autumn weather gracing our city.

International asset and wealth management hub

Hong Kong is Asia's leading international financial centre and asset and wealth management hub. Just now, Mary has already given you a good idea of the scale of assets under management and the number of family offices in this city. Let me supplement that many asset and wealth management firms are expanding their presence in Hong Kong. They include, of course, Standard Chartered. And no less optimistic are other prominent firms like UBS. Its Chief Executive commented in June this year that Hong Kong might well become the world's first in the asset management business by 2027.

A world of ultra-high-net-worth families and individuals have gathered in Hong Kong for a good reason. For you can place your wealth, here for good.

Unique strengths under "one country, two systems"

Hong Kong, after all, has very strong fundamentals. Our unique strength is the "one country, two systems" arrangement. While being part of China, we preserve all the defining characteristics that make this city unique: practising common law with a judiciary exercising powers independently; maintaining free flow of capital, goods, people and information; a low and simple tax system, and a currency pegged to the US dollar.

As President Xi Jinping made clear on various occasions, this arrangement is here to stay for the long term.

Staunch support from the country

Indeed, Hong Kong always enjoys staunch support from the Central Government. Over the years, the central authorities have rolled out highly favourable policies that benefit the city's progress and advancement. This is well illustrated in our financial market development. In April this year, for instance, the CSRC (China Securities Regulatory Commission) announced a series of measures to boost Hong Kong's capital market. That included injecting more liquidity into the Southbound Connect with Hong Kong, and supporting leading Mainland enterprises to list on our stock exchange. Now, over 100 such companies are in the queue for listing in Hong Kong.

Diverse investment offerings and opportunities

Above all, the prime value proposition of Hong Kong for family offices is the diverse array of investment offerings and opportunities we offer.

Speaking of our stock market, it is home to over 2 600 companies with a capitalisation of over US$4.6 trillion. Over the years, we have engaged in listing reforms, facilitating such companies from the new economy, biotech and hard-tech sectors to list on our stock exchange, and thus enlarging our pool of quality issuers.

No less vibrant is the bond market. Hong Kong ranked first in the world for 16 years in terms of international bond issuance arranged by Asian institutions. Last year, around US$90 billion of such bonds were issued, accounting for about a quarter of the market. We are also the hub for Renminbi bonds, including sovereign bonds issued by the central authorities as well as those by provincial and municipal governments.

Hong Kong offers a wide range of financial products that suit impact investors. For example, as Asia's leading green finance hub, we have on average issued over US$63 billion in green bonds and debt annually over the past three years, accounting for more than one-third of Asia's total. Over 230 ESG (environmental, social and governance) funds have been authorised by our Securities and Futures Commission, managing approximately US$170 billion in assets.

A rich array of investment products and professional services are underpinning a burgeoning ecosystem for families and their offices here in Hong Kong. The Government has rolled out a package of policies, including tax concessions to family-owned investment holding vehicles managed by single family offices in the city. This year, we have also established a Network of Family Office Service Providers comprising private banks, accounting and legal firms, trusts and other professional service firms, forming a strong nexus that cater to your needs.

Recent rally in our stock market

Speaking of investment, you may have noticed the recent rally in our stock market since the central authorities announced a stimulus package to inject liquidity to the banking sector and to provide more support to the real estate sector. Over this period, we have seen strong net buys from American and European investors, and they constituted some 85 per cent of the buy side by value. In terms of the background of those investors, 90 per cent of them are long-term fund managers and investment banks.

In January this year, when I visited Davos to attend the World Economic Forum, I met some investors and fund managers. The message I got from them then was clear – despite geo-economic fragmentation, the world of international investors remained interested in the opportunities of the Mainland market. They have long been waiting for the right time to invest here. Now, they are seeing the opportunity.

And beyond investors from the US and Europe, there is growing interest from our Middle East friends. For example, later this month, two ETFs (exchange-traded funds) will be listed on the Saudi Exchange for investing in our stock market.

Making a lasting impact with Hong Kong

Ladies and gentlemen, most if not all, family offices aim for more than just financial returns. They care about the collective good of our society and the planet.

To promote and support philanthropy endeavours, the annual Wealth for Good Summit held in Hong Kong since last year successfully brought together influential family office owners and decision-makers to explore strategies for effective philanthropy and wealth legacy. We will soon launch an "Impact Link" platform to foster the connection between family offices and high-potential, high-social impact philanthropy programmes.

There is also one important dimension of impact investing that I should not miss: innovation and technology. We are home to a vibrant, energetic and promising innovation circle, with many innovators from around the world who gather in Hong Kong, acting to change the world for the better, in AI (artificial intelligence), biotech, green tech, and many more areas. Many of these start-ups are based in our two innovation flagships, the Science Park and Cyberport. They have a global vision, and present valuable opportunities for investment. For instance, one start-up from Science Park has developed geospatial and sensory technologies for precision farming, helping farmers around the world to increase crop yield. Another start-up has developed 3D-printed reef tiles to help restore coral reefs and thus increase regional carbon sequestration capacity. The firm has now expanded to the Middle East.

Closing remarks

Ladies and gentlemen, in a nutshell, Hong Kong is where you can conserve and grow your wealth across generations. I believe the speakers at the forum tomorrow will further enlighten us with their valuable insights.

For now, please enjoy this good evening, and I wish you all a rewarding event tomorrow and an enjoyable experience in Hong Kong. Thank you very much.

Follow this news feed: East Asia