S for IT and SFST visit Cyberport (with photos)

The Secretary for Innovation and Technology, Mr Alfred Sit, and the Secretary for Financial Services and the Treasury, Mr Christopher Hui, visited Cyberport today (May 14) to learn more about its latest and future development, particularly in the financial technology (FinTech) area. Also joining the visit was the Permanent Secretary for Financial Services and the Treasury (Financial Services), Ms Michelle Li.

Accompanied by the Chairman of the Board of Directors of the Hong Kong Cyberport Management Company Limited, Dr George Lam, Mr Sit and Mr Hui started their visit at Smart-Space FinTech. The Chief Executive Officer of Cyberport, Mr Peter Yan, gave an overview of Cyberport's development, including the development of Cyberport as a FinTech community with some 400 FinTech companies and start-ups. Cyberport has launched the Cyberport Financial Practitioners FinTech Training Programme to promote the digital transformation of the industry, with the first batch of training programmes starting from March this year.

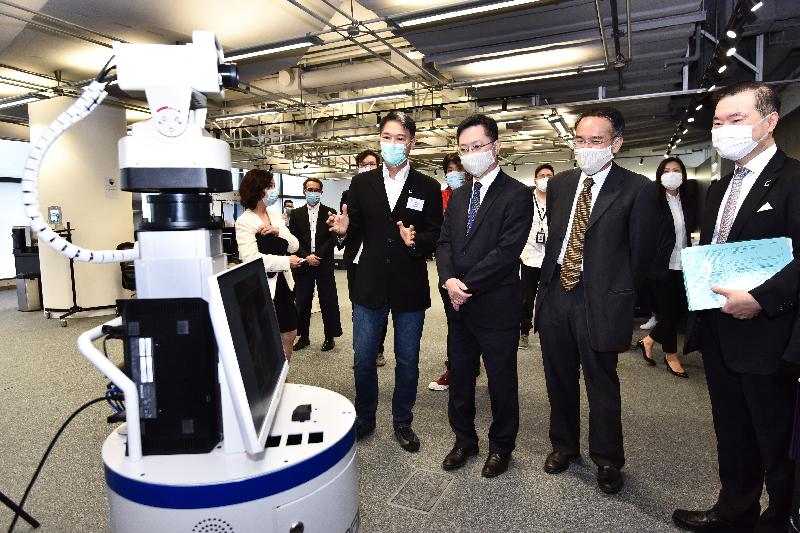

They also visited ZhongAn Technologies International Group Limited and Roborn Technology Limited. ZhongAn joined the Cyberport community through the Easy Landing Scheme in 2018 to tap the Hong Kong market. One of its subsidiaries has been granted a virtual banking license, the other is authorised as a virtual insurer. Roborn Technology, a Cyberport incubatee specialising in robotics, developed an epidemic prevention smart robot earlier on to detect body temperatures.

Mr Sit and Mr Hui then met with representatives of four start-ups to better understand the challenges and opportunities they are facing. They are Find Solution AI, which focuses on artificial intelligence; Bull.B, which is a digital solution provider; AQUMON, which provides digital financial advisory services in the area of FinTech; and OneDegree, which is a Cyberport incubatee and one of the virtual insurers licensed.

Mr Sit said that Cyberport has achieved remarkable results in driving FinTech development in recent years. The four companies authorised as virtual insurers are from the Cyberport community. Two out of the eight virtual banking licencees are members of the Cyberport community. The Government has earmarked $5.5 billion for the Cyberport Expansion Project for developing emerging digital technology areas with potential, such as InsurTech, RegTech and LawTech, thereby providing more opportunities for young people to pursue a career in innovation and technology (I&T) and further promoting the overall I&T development in Hong Kong to drive economic development and improve people's livelihood.

Mr Hui said that over the years, Hong Kong has witnessed strong growth of the FinTech sector from a relatively small niche to a sizeable and vibrant community. Hong Kong's maturing ecosystem, pioneering infrastructure, increasing receptiveness and adoption, conducive and forward-looking regulatory environment, coupled with traditional strengths in financial services, have elevated Hong Kong to one of the major FinTech hubs in Asia. Looking ahead, the Government will continue to work with all relevant sectors to promote and facilitate FinTech development using a multi-pronged approach under promotion, regulation, facilitation, talents and funding.

As Hong Kong's digital technology flagship, Cyberport is currently home to some 1 500 start-ups and technology companies. The accumulated funding raised by Cyberport start-ups has exceeded $12.6 billion. Four of its start-ups have reached unicorn status.