Statement by Commissioner Vestager on Commission decision imposing binding obligations on Gazprom to enable free flow of gas at competitive prices

*Check against delivery*

Today, the Commission has adopted a decision imposing on Gazprom a set of obligations. These obligations will significantly change the way Gazprom operates in Central and Eastern European gas markets. To the benefit of millions of European consumers who rely on gas to heat their homes and cook their food. And to the benefit of European businesses that rely on gas for production.

To recall: the Commission sent Gazprom a Statement of Objections in 2015. We set out our competition concerns that Gazprom pursued an overall strategy in its long-term contracts with customers to partition gas markets. This happened in eight Member States – Bulgaria, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland and Slovakia. This strategy may have enabled Gazprom to charge higher gas prices in five of these Member States.

Today’s decision puts an end to this behaviour by Gazprom. It removes obstacles created by Gazprom, which stand in the way of the free flow of gas in Central and Eastern Europe.

Because all companies doing business in Europe have to respect our rules on competition. No matter where they are from.

But more than that – our decision provides a tailor-made rulebook for Gazprom’s future conduct. It obliges Gazprom to take positive steps to further integrate gas markets in the region and to help realise a true internal market for energy in Europe.

And it gives Gazprom customers in Central and Eastern Europe an effective tool to make sure the price they pay is competitive. In other words, customers can ensure that their gas price will now be driven by the competitive gas prices that already exist in Western Europe.

As always, this case is not about the flag of the company – it is about achieving the outcome that best serves European consumers and businesses.

Details of Gazprom’s obligations

So, how exactly will Gazprom’s behaviour in the region change after the decision?

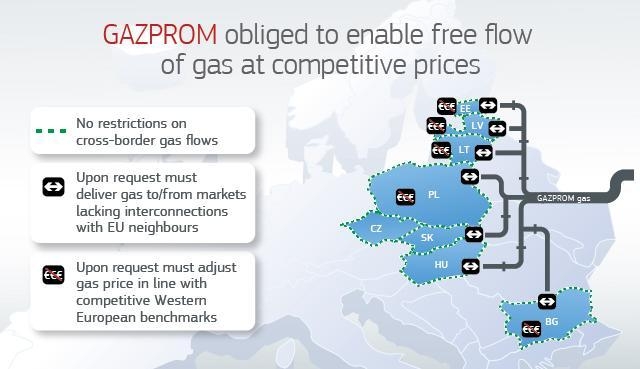

There are three parts to Gazprom’s obligations: That Gazprom’s customers are free to decide what happens with the gas they have bought, that they have more flexibility on where they want Gazprom to deliver it, and that they pay a competitive price for the gas.

So, the first two parts are about enabling gas to flow freely in Central and Eastern Europe.

First, Gazprom has to remove any contract provisions that prevent customers from re-selling gas across national borders. As well as any other provision that reduces a customer’s incentives to re-sell gas across borders, such as clauses that give Gazprom a share of the re-sale profit.

In future it will be for the customer – and not Gazprom – to decide what happens to the gas they have bought. That is an important condition for gas to be traded effectively by Gazprom’s customers.

But for gas to actually flow freely across Central and Eastern Europe, it is also necessary to have the infrastructure for its transport, namely interconnectors that link national gas markets with each other. Unfortunately, the availability of such interconnectors is still insufficient in parts of the region, namely in the Baltic States and in Bulgaria.

That is why we made sure Gazprom’s obligations don’t stop at just removing contractual barriers: the second part requires Gazprom to take positive steps to further integrate these gas markets.

For example, Gazprom must give customers an option to change where they want their gas delivered to. Customers that bought gas, originally for delivery to Hungary, Poland or Slovakia, can have all or part of it delivered to Bulgaria or the Baltic States instead. Gazprom must offer these swaps in both directions for a fixed transparent fee.

This means that gas can flow to and from the isolated markets as if the gas interconnectors existed already. It will allow Gazprom’s customers to seek new business opportunities even before interconnectors become available, to the benefit of consumers and businesses in Bulgaria and the Baltic States.

These obligations on Gazprom will increase cross-border competition and lead to better integrated markets, which should help keep down gas prices.

But we wanted to enable customers directly to ensure that prices in the region will be competitive. That’s because one of our competition concerns was that Gazprom was charging higher prices in five countries, namely Bulgaria, Estonia, Latvia, Lithuania and Poland.

We were concerned that customers in those countries faced higher prices than could be justified, compared to competitive gas prices in Western Europe.

That’s why the third part of Gazprom’s obligations is about giving customers in these countries an effective tool to make sure the price they pay is competitive.

In future, these customers will have the right to get their gas price adjusted, if it diverges from competitive benchmarks. These explicitly refer to prices quoted on Western European liquid gas trading hubs in Germany and in the Netherlands. If Gazprom does not agree to the customer’s demand within 120 days, an arbitrator is appointed that will impose a competitive gas price that takes full account of these benchmarks.

This will make sure that customers in these countries will never again face gas prices that are not competitive compared to the prices in Western Europe.

Finally, the obligations also address the concern that Gazprom may have used its market position in gas supply in Bulgaria to obtain favourable treatment concerning gas infrastructure. In particular, Gazprom cannot seek any damages from its Bulgarian partners following the termination of the South Stream project.

So, our decision today imposes on Gazprom a strict set of rules on how to do business in Central and Eastern Europe. It imposes clear obligations on Gazprom and gives effective rights to Gazprom’s customers. Combined, this will enable the free flow of gas at competitive prices.

Feedback from market test

We reached this decision also thanks to extensive input from a wide range of stakeholders – governments, national competition authorities, gas wholesalers, industry associations and academics. We had asked for their views on an earlier version of the proposal in March last year, and I would like to thank each and every one of them for their contribution.

It helped us in our intensive discussions with Gazprom since the market test, leading to this final set of obligations we imposed today. A lot of different big and small pieces needed to come together, like cogs in a machine, for these obligations to be effective.

To name just a few of the improvements we made: More customers will be able to benefit from the option to have Gazprom deliver part of or all their gas to Bulgaria or the Baltic States, instead of the destination they had initially agreed. Or the other way round. And these customers are given much more flexibility and safeguards. They can swap smaller quantities of gas at shorter notice. Plus, the fees that Gazprom may charge for this service are fixed at a low level to make the swap financially attractive. They are about 30% lower than in the initial proposal. Finally, Gazprom can only refuse to perform the swap if there is no transmission capacity.

Another example for an improvement concerns the right of customers with long-term contracts to adjust their gas price. Now, Gazprom has to give this right not only to its existing but also to future customers in the countries concerned.

Imposing obligations versus a fine

So, we have come a long way to get to this solution. In line with our standard rules, we can implement such a solution because it fully addresses our competition concerns. But I know that some would have liked to see us fine Gazprom instead, no matter the solution on the table.

However, a fine would not have achieved all of our competition objectives in this case. We can only make sure that Gazprom takes positive steps to integrate isolated gas markets, if Gazprom commits to do so. And we can only offer Gazprom’s customers an effective right to adjust their gas price, if we bind Gazprom to a structured process.

With today’s decision Gazprom has accepted that it has to play by our common European rules, if it wants to sell its gas in Europe. In fact, it has accepted to play by a rulebook that is tailor-made to ensure that European consumers can benefit from the free flow of gas at competitive prices.

If Gazprom fails to comply with any of its obligations, the consequences would be serious. The Commission can then impose a fine of up to 10% of the company’s worldwide turnover. We can do so without having to prove an infringement of EU antitrust rules. In 2013, for example, we fined Microsoft over half a billion euros when the company broke its obligations on choice of web browsers. In other words, the case doesn’t stop with today’s decision – rather it is the enforcement of the Gazprom obligations that starts today.

So this decision reaches the outcome that best serves European consumers and businesses.

Energy Union

And it also matters to our climate. If we want to achieve our ambitions from the Paris Agreement we need to increase the share in our energy mix of renewable energy, such as wind and solar. That also means we need gas as a flexible back-up capacity for the days when the sun is not shining and the wind is not blowing.

At the same time, effective competition in European gas markets of course cannot be achieved by the enforcement of competition rules alone. It also depends on how much you invest into gas supply diversification. As well as on legislation to complete our Energy Union. My colleagues Maroš Šefčovič and Miguel Arias Cañete have made a lot of progress on this already.

That also shows why we have both regulation and competition enforcement. Because it is when competition enforcement and regulation each fulfil their role that we get gas markets that really serve European consumers and businesses.