European Semester: The Autumn Package explained

The Autumn package represents the beginning of the 2019 European Semester cycle of economic and social policy coordination.

Today, the Commission presents:

- A number of steps under the Stability and Growth Pact

THE 2019 ANNUAL GROWTH SURVEY (AGS)

The Annual Growth Survey (AGS) sets out the general economic and social priorities for the EU and offers policy guidance for the following year. It aims to encourage sustained economic and social convergence on the basis of the so-called “virtuous triangle” of boosting investment, pursuing structural reforms and ensuring responsible public finances.

It also builds on the most recent data of the Autumn 2018 Economic Forecast and the messages emerging from the Alert Mechanism Report and the draft Joint Employment Report.

What are the main priorities outlined in the 2019 Annual Growth Survey?

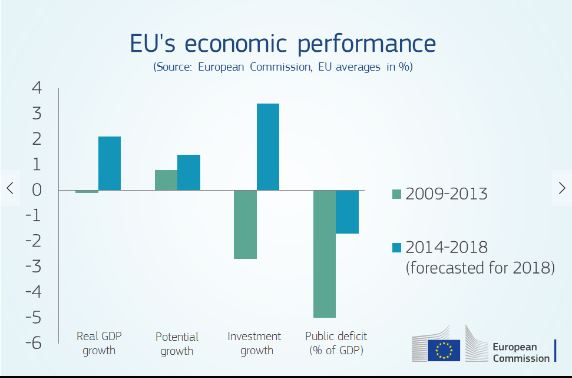

The 2019 AGS comes in a context of sustained, but less dynamic economic growth in Europe. This provides an opportunity to implement the reforms needed to address pressing challenges, which is even more urgent given rising global uncertainty and possible internal risks.

The AGS sets out priorities to guide national reform plans and complement efforts made at EU level to provide the conditions for inclusive and sustainable growth. These include:

- delivering high-quality investment and targeting investment gaps in research and innovation, in education, training and skills and infrastructure;

- focusing on reforms that increase productivity growth, inclusiveness and institutional quality;

- ensuring macro-financial stability and sound public finances.

What economic progress has been made since last year?

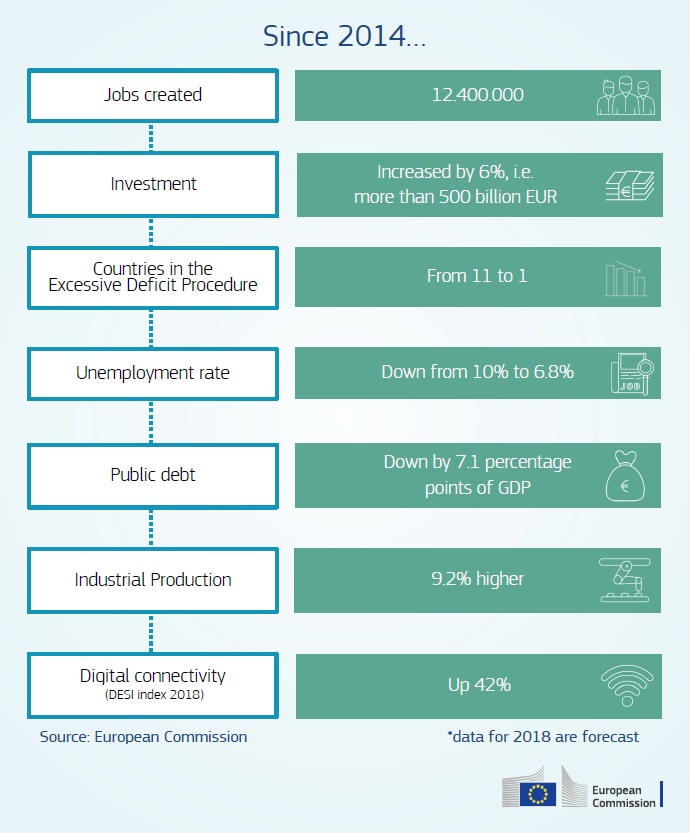

The EU and euro area economies have now been growing for 22 consecutive quarters. Despite a more uncertain environment, all Member States’ economies are forecast to continue growing, though at a slower pace, thanks to the strength of domestic consumption and investment. The number of people in employment has reached the highest level ever recorded, with 239 million people now employed in the EU. Significant progress has been made towards ensuring that Europe’s public finances are sound, sustainable and capable of absorbing future shocks. 2018 will be the first year where the aggregate euro area public deficit is below 1%. For the first time since 2007, investment is set to rise in all EU countries in 2019. As of November 2018, the Juncker Plan is set to trigger almost €360 billion in investments. Greece has successfully concluded its European Stability Mechanism (ESM) stability support programme, with its place at the heart of the euro area secured.

Nevertheless, the latest forecast suggests that economic growth is projected to moderate and continues to face significant downside risks.

THE 2019 ALERT MECHANISM REPORT (AMR)

The so-called “six-pack” legislation adopted in 2011 introduced a system to monitor broader economic developments, to detect early on problems such as credit and property bubbles, issues in external sustainability or falling competitiveness. The Macroeconomic Imbalance Procedure (MIP) is integrated in the European Semester and is kicked-off by an Alert Mechanism Report (AMR) which identifies Member States for which the Commission should undertake in-depth reviews to assess whether they are experiencing macroeconomic imbalances. The analysis in the AMR is based on the economic reading of a scoreboard of agreed indicators.

What are the main findings of this Alert Mechanism Report?

The 2019 AMR finds that the correction of macroeconomic imbalances in the EU, including the easing of some persisting challenges in the financial sector, is progressing on the back of sustained, but moderating, growth.

However, challenges remain. Potential sources of risk are broadly the same as those identified in the 2018 AMR. Large current account surpluses persist in certain countries, while competitiveness developments have become less supportive of rebalancing. Private sector deleveraging has benefited from the economic expansion but remains uneven, with large stocks of debt not correcting with sufficient pace. Although decreasing, the level of non-performing loans is still high in some countries. At the same time, a number of countries display signs of possible overheating, mainly linked to fast-growing unit labour costs implying reduced cost competitiveness, and house price growth from already relatively elevated levels.

Which Member States will be subject to an in-depth review (IDR)?

On the basis of the analyses in the Alert Mechanism Report (AMR), it is proposed that 13 Member States should be covered by an in-depth review in 2019. As is customary in this procedure, these include each of the Member States identified as having imbalances in the previous round of the Macroeconomic Imbalances Procedure (MIP): Bulgaria, Croatia, Cyprus, France, Germany, Ireland, Italy, the Netherlands, Portugal, Spain, and Sweden. In addition to these Member States, Greece and Romania will also be subject to IDRs. The Commission will present the in-depth reviews as part of the Country Reports to be published in early 2019.

THE DRAFT JOINT EMPLOYMENT REPORT 2019

The Joint Employment Report (JER) is mandated by Article 148 of the Treaty on the Functioning of the European Union (TFEU). It provides an annual overview of the main employment and social developments in the EU. In addition, the Joint Employment Report 2019 monitors Member States’ performance in relation to the Social Scoreboard accompanying the European Pillar of Social Rights. The current draft version, presented by the Commission, will be discussed with the Employment Committee and the Social Protection Committee, with a view to final adoption by the Employment, Social Policy, Health and Consumer Affairs Council (EPSCO) in March 2019.

What are the main findings of the draft Joint Employment Report (JER)?

The economic recovery of recent years has been particularly job intensive. Unemployment levels are reaching historic lows. The number of people in employment has reached the highest level ever recorded, with 239 million people now employed in the EU. This corresponds to 12 million more people at work since the start of this Commission. On current trends, the EU is on course to meet its Europe 2020 target of a 75% employment rate by 2020.

Particularly steady progress is being made in increasing employment rates of women and elderly workers. The share of people at-risk-of poverty or social exclusion decreased markedly in 2017, with more than five million people no longer experiencing poverty or social exclusion compared to 2016. The total number of people at risk of poverty or social exclusion has fallen below pre-crisis levels. In a context of improving labour markets and declining poverty, 13 out of the 14 headline indicators of the Social Scoreboard accompanying the European Pillar of Social Rights recorded an improvement over the last year, on average.

However, not all Member States and groups within society are reaping the full benefits of the current positive economic environment. Unemployment remains unacceptably high in a number of Member States. Labour market integration remains difficult for specific groups, including the low-skilled workers, the youth, people with disabilities and people with a migrant background.

How is the European Pillar of Social Rights reflected in the European Semester?

The European Pillar of Social Rights, proclaimed in 2017, has become an essential compass of the European Semester since the 2018 cycle. The 20 principles embedded in the Pillar inform the analysis of the employment and social situation in Member States and forms the basis of policy recommendations directed towards them. The draft Joint Employment Report adopted today includes, for the second year, the findings of the Social Scoreboard, which was set up as an important monitoring tool to assess Member States’ performance vis-à-vis key dimensions of the Pillar. Member States’ performances are assessed along 14 headline indicators through a methodology agreed with the Council – with grades ranging from “critical situations” to “best performers”. This classification will also inform the more detailed analysis of Member States’ situation in the Country Reports, which will be published early in 2019.

THE RECOMMENDATION ON THE ECONOMIC POLICY OF THE EURO AREA

The euro area recommendation provides tailored advice to euro area Member States on issues relevant for the functioning of the euro area as a whole, such as policies related to correcting macro-economic imbalances, the euro area fiscal stance and the completion of the Economic and Monetary Union. It is published early in the European Semester, ahead of country-specific discussions, so that common challenges are discussed, agreed and then collectively reflected in country-specific actions. This year, the euro area recommendation has been streamlined to have a stronger focus on the key challenges at stake for the coming year.

What is the 2019 euro area recommendation?

The Commission recommendation consists of five parts:

- Deepen the Single Market, improve the business environment, and pursue resilience-enhancing product and services market reforms. Reduce external debt and pursue reforms to boost productivity in euro area Member States with current account deficits and strengthen the conditions that support wage growth, respecting the role of social partners, and implement measures that foster investment in euro area Member States with large current account surpluses.

- Rebuild fiscal buffers in euro area countries with high levels of public debt, support public and private investment and improve the quality and composition of public finances in all countries.

- Shift taxes away from labour and strengthen education systems and investment in skills as well as the effectiveness and adequacy of active labour market policies and social protection systems across the euro area.

- Make the backstop for the Single Resolution Fund operational, set up a European Deposit Insurance Scheme and strengthen the European regulatory and supervisory framework. Promote an orderly deleveraging of large stocks of private debt. Swiftly reduce the level of non-performing loans in the euro area and prevent their build up, including by removing debt bias in taxation.

- Make swift progress on completing the Economic and Monetary Union, taking into account the Commission proposals, including those concerning the financial sector as well as the Reform Support Programme and the European Investment Stabilisation Function under the proposal for the 2021-2027 Multiannual Financial Framework.

OPINIONS ON THE DRAFT BUDGETARY PLANS

The Commission has also completed its assessment of euro area Members States’ Draft Budgetary Plans (DBP) compliance with the provisions of the Stability and Growth Pact (SGP) for 2019, taking into account its recent Autumn 2018 Economic Forecast and consultations with Member States. It has adopted Opinions for all 19 euro area Member States’ DBPs today.

What are the findings?

The Autumn 2018 Economic Forecast projects the aggregate euro area headline deficit, which has been on a continuous downward trend since 2010, to fall to 0.6% of GDP in 2018, but then to increase to 0.8% of GDP in 2019. For the first time since the creation of the euro, no euro area Member State is forecast to have a deficit above the 3% of GDP threshold in 2019. The euro area debt-to-GDP ratio is expected to continue its declining trend of recent years and to fall from around 87% in 2018 to around 85% in 2019.

The number of Member States at or above their medium-term budgetary objectives is set to increase from seven to eight Member States, with Austria moving just above its medium-term budgetary objective in 2019. The aggregate structural deficit is expected to increase by 0.3% of potential GDP in 2019. It is, in particular, driven by a projected increase in Italy’s structural deficit by 1.2% of GDP. Expansionary fiscal policies expected in Member States with fiscal space, notably Germany and the Netherlands, also contribute to the change in the overall euro area figure. Member States continue to have very different fiscal positions in terms of debt and sustainability challenges. Due to the lack of fiscal adjustment in some highly-indebted Member States, fiscal policies are insufficiently differentiated, resulting in a slightly expansionary and pro-cyclical fiscal stance for the euro area as a whole.

Preventive arm of the Stability and Growth Pact

In the case of Italy, having assessed the revised DBP presented on 13 November 2018, the Commission confirms the existence of a particularly serious case of non-compliance with the Recommendation addressed to Italy by the Council on 13 July 2018. The Commission had already adopted an Opinion on 23 October 2018 identifying a particularly serious non-compliance in the initial DBP presented by Italy on 16 October 2018.

For ten countries – Germany, Ireland, Greece, Cyprus, Lithuania, Luxembourg, Malta, the Netherlands, Austria, and Finland –, the Draft Budgetary Plans are found to be compliant with the requirements for 2019 under the Stability and Growth Pact.

For three countries – Estonia, Latvia and Slovakia –, the Draft Budgetary Plans are found to be broadly compliant with the requirements for 2019 under the Stability and Growth Pact. For these countries, the plans might result in some deviation from the country’s medium-term budgetary objective, taking into account any allowances where relevant.

For four countries – Belgium, France, Portugal, and Slovenia –, the Draft Budgetary Plans pose a risk of non-compliance with the requirements for 2019 under the Stability and Growth Pact. The Draft Budgetary Plans of these Member States might result in a significant deviation from the adjustment paths towards the respective medium-term budgetary objective. For Belgium, France, and Portugal non-compliance with the (transitional) debt reduction benchmark is also projected.

Corrective arm of the Stability and Growth Pact (i.e. Excessive Deficit Procedure)

Spain’s headline deficit is projected to fall below 3% next year and the country is set to exit the Excessive Deficit Procedure, which means that Spain would become subject to the preventive arm of the Pact as of next year. In this context, the DBP presented by Spain is found to be at risk of non-compliance with the Stability and Growth Pact in 2019. This is based on the Autumn 2018 Economic Forecast’s projection of a significant deviation from the required adjustment path towards the medium-term budgetary objective and non-compliance with the transitional debt reduction benchmark in 2019.

STEPS UNDER THE STABILITY AND GROWTH PACT

The Commission has also taken a number of steps under the Stability and Growth Pact:

Italy

For Italy, the Commission has carried out a new assessment of the prima facie lack of compliance with the debt criterion. At 131.2% of GDP in 2017, the equivalent of

€37,000 per inhabitant, Italy’s public debt exceeds the 60% of GDP reference value of the Treaty. This new assessment was necessary because Italy’s fiscal plans for 2019 represent a material change in the relevant factors analysed by the Commission last May. The analysis presented in this new report under Article 126(3) of the Treaty on the Functioning of the European Union includes the assessment of all relevant factors and notably: (i) the fact that macroeconomic conditions, despite recently intensified downside risks, cannot be argued to explain Italy’s large gaps to compliance with the debt reduction benchmark, given nominal GDP growth above 2% since 2016; (ii) the fact that the government plans imply a marked backtracking on past growth-enhancing structural reforms, in particular the past pension reforms; and above all (iii) the identified risk of significant deviation from the recommended adjustment path towards the medium-term budgetary objective in 2018 and the particularly serious non-compliance for 2019 with the recommendation addressed to Italy by the Council on 13 July 2018, based on both the government plans and the Commission 2018 autumn forecast. Overall, the analysis suggests that the debt criterion as defined in the Treaty and in Regulation (EC) No 1467/1997 should be considered as not complied with, and that a debt-based Excessive Deficit Procedure is thus warranted.

Hungary

For Hungary, the Commission established that no effective action was taken in response to the Council recommendation of June and proposes that the Council adopts a revised recommendation to Hungary to correct its significant deviation from the adjustment path towards the medium-term budgetary objective. In June 2018, the Council had issued a recommendation of an annual structural adjustment of 1% of GDP in 2018 to Hungary under the Significant Deviation Procedure (SDP). In light of developments since and following the lack of effective action by Hungary to correct its significant deviation, the Commission now proposes a revised recommendation of an annual structural adjustment of at least 1% of GDP in 2019. The public deficit has increased in Hungary from -1.6% in 2016 to -2.4% in 2018, and is forecast to remain slightly below -2% in the coming two years.

Romania

For Romania, the Commission established that no effective action was taken in response to the Council recommendation of June and proposes that the Council adopts a revised recommendation to Romania to correct its significant deviation from the adjustment path towards the medium-term budgetary objective. In June 2018, the Council had issued a recommendation of an annual structural adjustment of 0.8% of GDP in both 2018 and 2019 to Romania under the SDP. In light of developments since and following the lack of effective action by Romania to correct its significant deviation, the Commission now proposes a revised recommendation of an annual structural adjustment of at least 1% of GDP in 2019. The public deficit has increased in Romania from -0.5% in 2015 to -2.9% in 2016 and is forecast to reach

-3.3% in 2018, -3.4% in 2019 and -4.7% in 2020: this is the highest deficit in the EU.

What is a Significant Deviation Procedure?

In addition to respecting the 3% of GDP deficit limit as part of the corrective arm of the Stability Growth Pact, Member States must comply with the requirements of the preventive arm of the Pact. The objectives of the preventive arm are to promote sound and sustainable public finances and to prevent excessive deficits and debts from occurring. To achieve this, the Significant Deviation Procedure was introduced as part of the 6-pack reform in 2011. Its purpose is to provide a warning to Member States when a significant deviation from the requirements of the Preventive Arm of the Pact is observed and to bring the Member State back to (or closer to) the fiscal position that would have been achieved if the deviation had not occurred.

FIRST ENHANCED SURVEILLANCE REPORT FOR GREECE

The Commission has also adopted the first Enhanced Surveillance Report for Greece, following the activation of the framework.

The Commission has activated enhanced surveillance for Greece, effective as from the conclusion of the ESM programme on 20 August 2018. Enhanced surveillance provides a comprehensive framework for monitoring economic developments and the pursuit of policies needed to ensure a sustainable economic recovery. The report covers the latest economic and financial developments in Greece as well as an assessment of implementation of reform commitments given by Greece to the European partners at the June 2018 Eurogroup. The publication of the report follows the first post-programme mission to Greece which took place from 10 to 14 September 2018.

What are the conclusions of the report?

Greece has presented a draft budget which, on the basis of current projections, ensures compliance with its commitment to achieve a primary surplus of 3.5% of GDP. Progress with reforms in other areas is mixed and the authorities will need to accelerate implementation to meet their end-2018 objectives.

How will the conclusions of this report impact the activation of the debt relief measures for Greece?

The activation of policy-contingent debt measures, agreed as part of the significant package of debt measures agreed at the Eurogroup meeting of 22 June 2018, will be contingent on a positive assessment in the second report under the enhanced surveillance framework. This report will be published early next year.

A positive enhanced surveillance report will enable the transfer back to Greece of the budgetary equivalent of income from national central banks’ holdings of Greek bonds (so-called SMP/ANFA profits) and the elimination of the step-up interest rate charged on European Financial Stability Facility (EFSF) loans.

These measures will be activated in equal amounts potentially on a semi-annual basis, provided Greece fulfils its commitments.

Given that the first set of specific commitments had a deadline of end-2018, the current report could only check progress on these measures and was not expected to lead to the activation of policy-contingent debt measures. This second report will assess implementation of commitment with a deadline of end-2018 and will be published early next year.

BACKGROUND

Press release on the European Semester Autumn Package

Draft Joint Employment Report 2019

Communication on the 2019 Draft Budgetary Plans of the euro area

Article 126(3) report on Italy

Enhanced Surveillance Report for Greece

Follow Vice-President Dombrovskis on Twitter: @VDombrovskis

Follow Commissioner Moscovici on Twitter: @pierremoscovici

Follow DG ECFIN on Twitter: @ecfin