Euro area financial integration improves in 2017

PRESS RELEASE

3 May 2018

- Reintegration trend strongly resumed in prices but not in quantities

- Euro area financial integration more resilient to adverse shocks

- Further development of equity markets would promise to foster innovation, growth and risk sharing in Europe

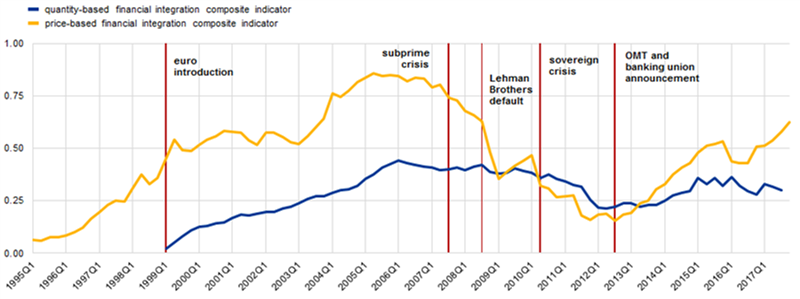

Financial integration in the euro area resumed last year, the European Central Bank’s (ECB) annual report on Financial Integration in Europe shows. The report was published today at a joint conference with the European Commission in Frankfurt. The resumption of financial integration after the volatile year 2016 was pronounced in prices but not in quantities (see chart). The price-based integration process was driven in particular by convergence to similar levels across countries in equity returns and, to a somewhat lesser extent, in bond yields. The main force behind this capital market-oriented process was the strengthening and broadening of the economic expansion in the euro area, which was quite uniform overall.

Chart: Price-based and quantity-based composite indicators of financial integration

Sources: ECB and ECB calculations.

Notes: The price-based composite indicator aggregates ten indicators covering the period from the first quarter of 1995 to the fourth quarter of 2017, while the quantity-based composite indicator aggregates five indicators available from the first quarter of 1999 to the third quarter of 2017. The indicators are bounded between zero (full fragmentation) and one (full integration). Increases in the indicators signal greater financial integration.

Reasons why quantity-based financial integration is not yet recovering are that euro area cross-border interbank trading remains relatively low and cross-border equity or bond holdings do not show particular trends up or down over the reporting period. Investment funds, however, tend to play a favourable role in quantity-based financial integration, as many of their portfolios are quite geographically diverse, enabling them to help other investors spread asset holdings across countries.

Overall, euro area financial integration has become more resilient to adverse shocks over time. This is reflected in medium-term increases in foreign equity investment relative to foreign debt investment within the euro area, and in foreign direct investment relative to portfolio equity investment. Also the proportion of cross-border retail bank lending relative to interbank lending has gradually increased over a longer period of time. The only exception is the development in cross-border short-term debt holdings, which have recently increased relative to long-term debt holdings.

As there is room for further financial integration and as the extent of cross-border private financial risk sharing remains relatively low, the completion of the European banking union and further progress with the capital markets union should remain policy priorities.

The ECB’s Vice-President Vítor Constâncio said: “It is a big waste to have taken the huge step to adopt a single currency and continue to forgo the benefits that could be reaped by creating a true banking and capital markets union. I believe that euro area countries should forge ahead in enhanced cooperation in order to more rapidly achieve CMU.”

Recent progress in risk reduction should be matched by steps towards risk sharing through a credible common fiscal backstop for the Single Resolution Fund and the introduction of a European deposit insurance scheme.

Further improving and harmonising insolvency frameworks can significantly enhance the functioning of both the banking and the capital markets union. Moreover, new research by the ECB and others outlined in the report suggests that initiatives to further develop equity markets in Europe would promise to foster innovation, growth and cross-country risk sharing. New initiatives may be needed to stimulate financing of the real economy through public and private equity markets, which play particularly important roles for the growth of innovative industries, for private financial risk sharing and for the resilience of financial integration.

For media queries, please contact Uta Harnischfeger, tel.: +49 69 1344 6321.