The European Securities and Markets Authority (ESMA), the EU securities markets regulator, today publishes the first complete risk dashboard for 2020, and highlights the very high risks in all areas of ESMA’s remit. The assessment remains at the same level as the separate risk update published on 2 April.

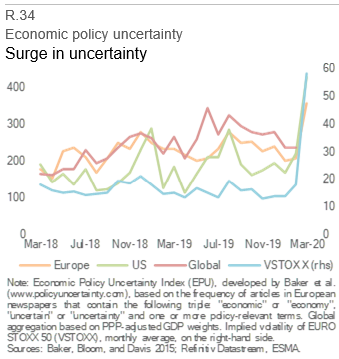

During the first quarter of 2020, the equity markets saw very large corrections due to a combination of the Covid-19 pandemic and existing valuation risks. Since then, and despite the high uncertainty and worsening economic outlook, markets have seen a remarkable rebound. This should also be viewed in light of massive public policy interventions in the EU and elsewhere.

This potential decoupling of financial market performance and underlying economic activity leads ESMA to see a prolonged period of risk to institutional and retail investors of further – possibly significant – market corrections and very high risks across the whole of the ESMA remit. The extent to which these risks may materialise will critically depend on two drivers: the economic impact of the pandemic, and any occurrence of additional external events in an already fragile global economic environment.

|

|

Follow this news feed: EU