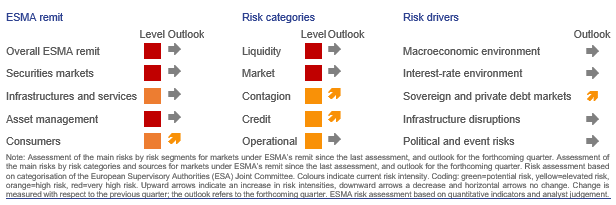

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has today published its first Risk Dashboard (RD) for 2021 covering the first quarter of the year. The RD highlights that the main risk for EU financial markets remains that posed by a sudden risk reassessment, amid the general decoupling of securities prices from economic fundamentals, and is maintains its risk assessment at a very high level.

Valuations in EU financial markets for most market segments are now at or above pre-COVID-19 levels. They remain highly sensitive to events and volatility, as shown by the market movements related to Gamestop and the impact that a potentially slow roll-out of vaccines had on equity prices.

Fixed income valuations are now far above their pre-COVID-19 levels, in part due to continued monetary policy support. A sudden risk reassessment, amid the general decoupling of securities prices from economic fundamentals, remains the main risk for EU financial markets and ESMA therefore maintains its risk assessment. Credit risk is likely to increase further due to increasing corporate and public debt levels.

Looking ahead, ESMA anticipates a prolonged period of risk to institutional and retail investors of further – possibly significant – market corrections and sees very high risks across its whole remit. The extent to which these risks will further materialise will critically depend on market expectations on monetary and fiscal policy support as well as on the pace of the economic recovery.

Follow this news feed: EU