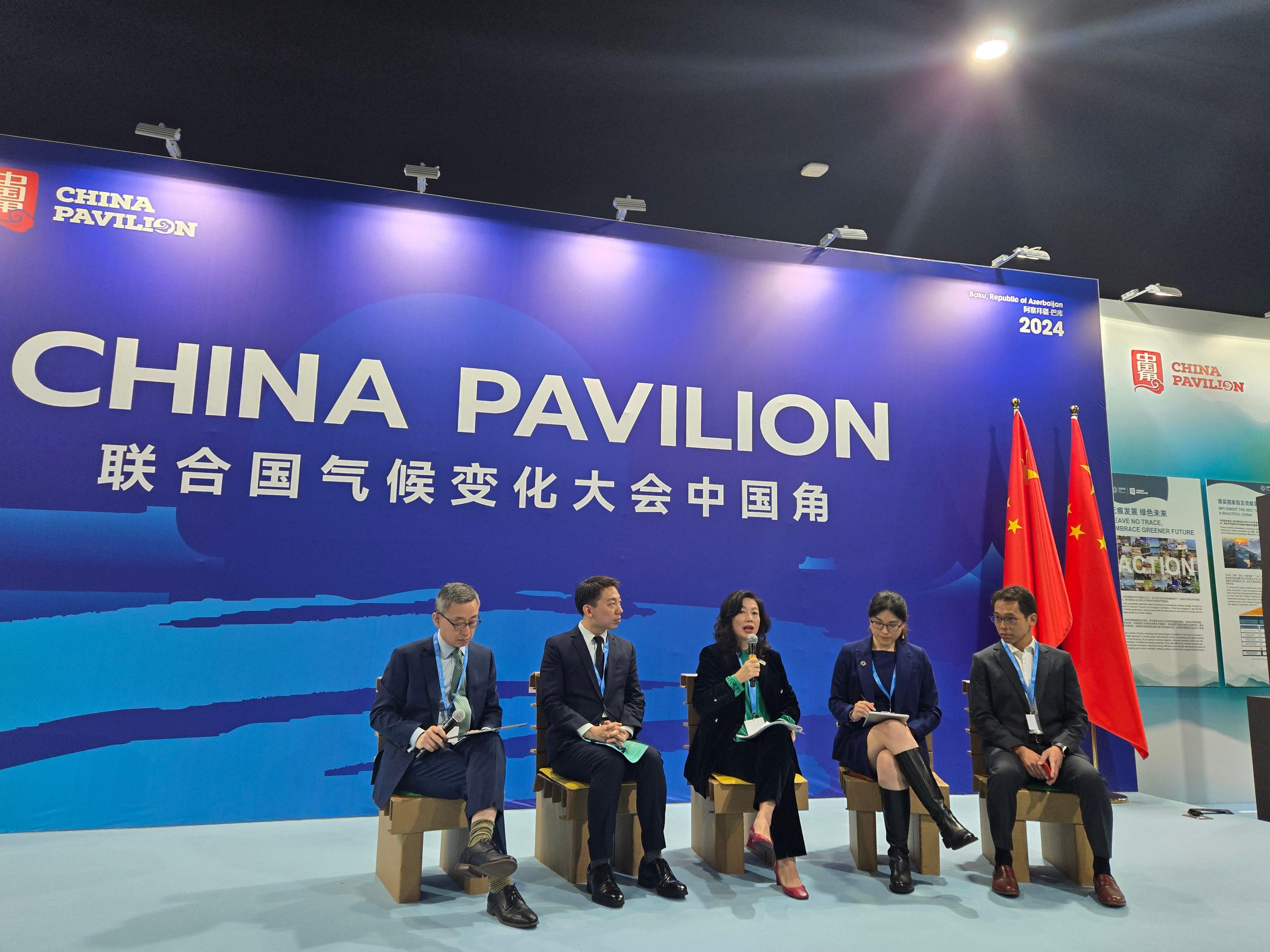

Following are the closing remarks by the Permanent Secretary for Financial Services and the Treasury (Financial Services), Ms Salina Yan, under the theme "Advancing Transition Finance and Cross-Border Green Financing – Engaging the Public to Achieve a Net-Zero Economy" at the China Pavilion's Side Event of the 29th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP29) co-organised by Friends of the Earth (HK) and the Financial Services Development Council in Baku, Azerbaijan today (November 11, Azerbaijan time):

Secretary Tse (Secretary for Environment and Ecology, Mr Tse Chin-wan), Plato (Secretary General of the Treelion Foundation and Chairperson of Friends of the Earth (HK), Mr Plato Yip), Daniel (Vice-Chairman of the Financial Services Development Council, Mr Daniel Fung), distinguished guests, ladies and gentlemen,

A big thank you to Friends of the Earth (HK) and the Financial Services Development Council for hosting this event on the first day of COP29 here in Baku in the China Pavilion.

My deep appreciation also goes to the Ministry of Ecology and Environment for its continued support to the Hong Kong Special Administrative Region (HKSAR)'s participation in COP related activities where we can share Hong Kong's perspectives in contributing to the global efforts in combating climate change.

We gather here to discuss the pressing issue of scaling up transition finance in the journey to achieve net zero for the global economy. The discussions just now have given us much food for thought. I, for one, have been much enlightened by the valuable views expressed by speakers from the perspectives of financial institutions, civil societies, the academia and green technology enterprises. This fully demonstrates that we need concerted efforts from all sectors of the society to deliver the goal for the sustainable growth and ultimately survival of the global village.

Harnessing our strength as an international financial centre with robust capital markets, Hong Kong can definitely help advance transition finance and cross-border green finance. We have main-streamed green finance in our financial services policy formulation and implementation. The results have been encouraging. To name but a few:

- The issuance of a total of HK$220 billion under the Government Green Bond Programme has helped finance more than 110 eligible green public projects. The bonds with tenure ranging from one to 30 years and denominated in different currencies, including RMB, Euro and USD, have been well received by international institutional investors and, where applicable, local retail investors with over subscriptions. Mainland municipal/provincial governments including Shenzhen, Hainan and Guangdong have also used Hong Kong as the platform to issue offshore RMB bonds, including green and blue bonds. And after two tranches of tokenised bond issuance, we are set to deepen the technological application in issuing future tokenised bonds.

- Separately, we now have over 230 authorised ESG (environmental, social, and governance) funds with assets under management over HK$1.3 trillion. We will soon consult the industry on proposals to expand the tax concession arrangements for funds and single family offices to cover emission derivatives and emission allowance.

- On market infrastructure, the Hong Kong Taxonomy for Sustainable Finance, published in May, provides a clear classification of green activities in sectors of power generation, transportation, construction, and water management. We will be consulting the industry on the expansion of the Taxonomy to cover transition activities as well.

- Our carbon trading marketplace, or Core Climate, provides access to quality carbon credits from over 50 certified projects across Asia, South America, and West Africa. These projects span vital initiatives in forestry, solar, wind, biomass, and we are more open to exploring co-operative initiatives in this space.

- On sustainability disclosure, we published a vision statement in March this year, outlining Hong Kong's vision to align the Hong Kong requirements fully with the International Financial Reporting Standards – Sustainability Disclosure Standards (ISSB Standards). For this, the Hong Kong Institute of Certified Public Accountants completed a public consultation last month on the Exposure Drafts for "Hong Kong Standards". We will launch a roadmap on the full adoption of the ISSB Standards within this year, making Hong Kong one of the very first jurisdictions to align its local requirements with the ISSB Standards.

- For the bankers in the room, you would also be aware that the Hong Kong Monetary Authority has just issued a Sustainable Finance Action Agenda mandating all banks to strive to achieve net zero in their own operations by 2030 and in their financed emissions by 2050. And we are going to lead by example. The Exchange Fund aims to achieve net-zero emissions for its investment portfolio by 2050 and deepen its dedicated focus on transition finance opportunities.

- Lastly, we organised a very successful Hong Kong Green Week in 2024. We are planning a re run with participants from public and private sectors around the world.

​The list goes on. In essence, the building of a greener future hinges upon an enabling policy environment, robust market infrastructure, and determining efforts to align with international standards. To take this forward, the HKSAR Government, under "one country, two systems", has been taking multi-pronged measures to consolidate Hong Kong's strength as an international green finance hub. We will continue to co-ordinate actions to provide an ecosystem with necessary knowledge, data, and technological support to the industry and society at large. On this opening day of COP29, I wish everyone meaningful discussions in the days ahead. Hong Kong stands ready to combine our pool of liquidity with portfolio management needs to serve the global green finance goals.

Thank you.

Follow this news feed: East Asia