Press release: LPC welcomes acceptance of its 2019 minimum wage rate recommendations

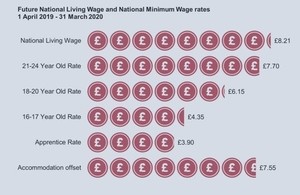

Future rates were announced by the Chancellor of the Exchequer in the Budget, in line with those recommended by the LPC. The National Living Wage (NLW), the statutory minimum for workers aged 25 and over, will increase by 4.9% to £8.21 per hour. Rates for younger workers will also increase above inflation and average earnings. They will apply from 1 April 2019.

Bryan Sanderson, Chair of the LPC, said:

I am pleased that the Government has again accepted in full the Low Pay Commission’s recommendations for future minimum wage rates. The increase in the National Living Wage (NLW) to £8.21 in April 2019 will ensure a pay rise for the lowest-paid workers that exceeds both inflation and average earnings.

Over the past year, the labour market has continue to perform well and the economy, while subdued, has met the criteria of ‘sustained growth’ set out in our remit for the NLW. We therefore recommended an increase in line with a path to 60 per cent of median earnings by 2020. On current forecasts, we estimate that the NLW will reach this target at a rate of £8.62 in 2020.

We recommended real-terms increases to the National Minimum Wage (NMW) rates for younger workers and apprentices, as the labour market conditions for these groups remain strong. These rates will continue to rise faster than both inflation and average earnings. We opted for smaller increases than we recommended last year because of slightly weaker labour market conditions for young people, combined with insufficient evidence to fully understand the impact of the largest increases in a decade implemented in April of this year. However, next year’s will still be some of the highest increases on record.

The 2019 Low Pay Commission Report, containing the underpinning analysis and evidence used to make these recommendations, will be published on 27 November.

The LPC’s rate recommendations comprised:

| Current rate | Future rate (from April 2019) | Increase | |

|---|---|---|---|

| NLW | £7.83 | £8.21 | 4.9% |

| 21-24 rate | £7.38 | £7.70 | 4.3% |

| 18-20 rate | £5.90 | £6.15 | 4.2% |

| 16-17 rate | £4.20 | £4.35 | 3.6% |

| Apprentice rate | £3.70 | £3.90 | 5.4% |

| Accommodation offset | £7.00 | £7.55 | 7.9% |

Notes:

- The rationale for each of our rate recommendations is set out in a letter from the Chair of the LPC to the Secretary of State for Business, Energy and Industrial Strategy.

- The National Living Wage is the statutory minimum wage for workers aged 25 and over. It was introduced in April 2016 and has a target of 60 per cent of median earnings by 2020, subject to sustained economic growth.

- Different rates apply to 21-24 year olds, 18-20 year olds, 16-17 year olds and apprentices aged under 19 or in the first year of an apprenticeship.

- Rates for workers aged under 25, and apprentices, are lower than the NLW in reflection of lower average earnings and higher unemployment rates. International evidence also suggests that younger workers are more exposed to employment risks arising from the pay floor than older workers. Unlike the NLW (where the possibility of some consequences for employment have been accepted by the Government), the LPC’s remit requires us to set the other rates as high as possible without causing damage to jobs and hours.

- The accommodation offset is a an allowable deduction from wages for accommodation, applicable for each day of the week. Further information is available here. It will increase to £7.55 per day.

- Our 2019 Report, containing the underpinning analysis and evidence used to make these recommendations, will be published on 27 November. In previous years it has been published on the same day as the rates were announced, but the early budget means that this has not been possible this year.

- The National Living Wage is different from the UK Living Wage and the London Living Wage. Differences include that: the UK Living Wage and the London Living Wage are voluntary pay benchmarks that employers can sign up to if they wish, not legally binding requirements; the hourly rate of the UK Living Wage and London Living Wage is based on an attempt to measure need, whereas the National Living Wage is based on a target relationship between its level and average pay; the UK Living Wage and London Living Wage apply to workers aged 18 and over, the National Living Wage to workers aged 25 and over. The Low Pay Commission has no role in the UK Living Wage or the London Living Wage.

- The Low Pay Commission is an independent body made up of employers, trade unions and experts whose role is to advise the Government on the minimum wage. The rate recommendations were agreed unanimously by the Commission.

The nine Low Pay Commissioners are:

- Bryan Sanderson

- Professor Sarah Brown

- Professor Richard Dickens

- Kate Bell

- Kay Carberry

- Simon Sapper

- Neil Carberry

- Clare Chapman

- Martin McTague