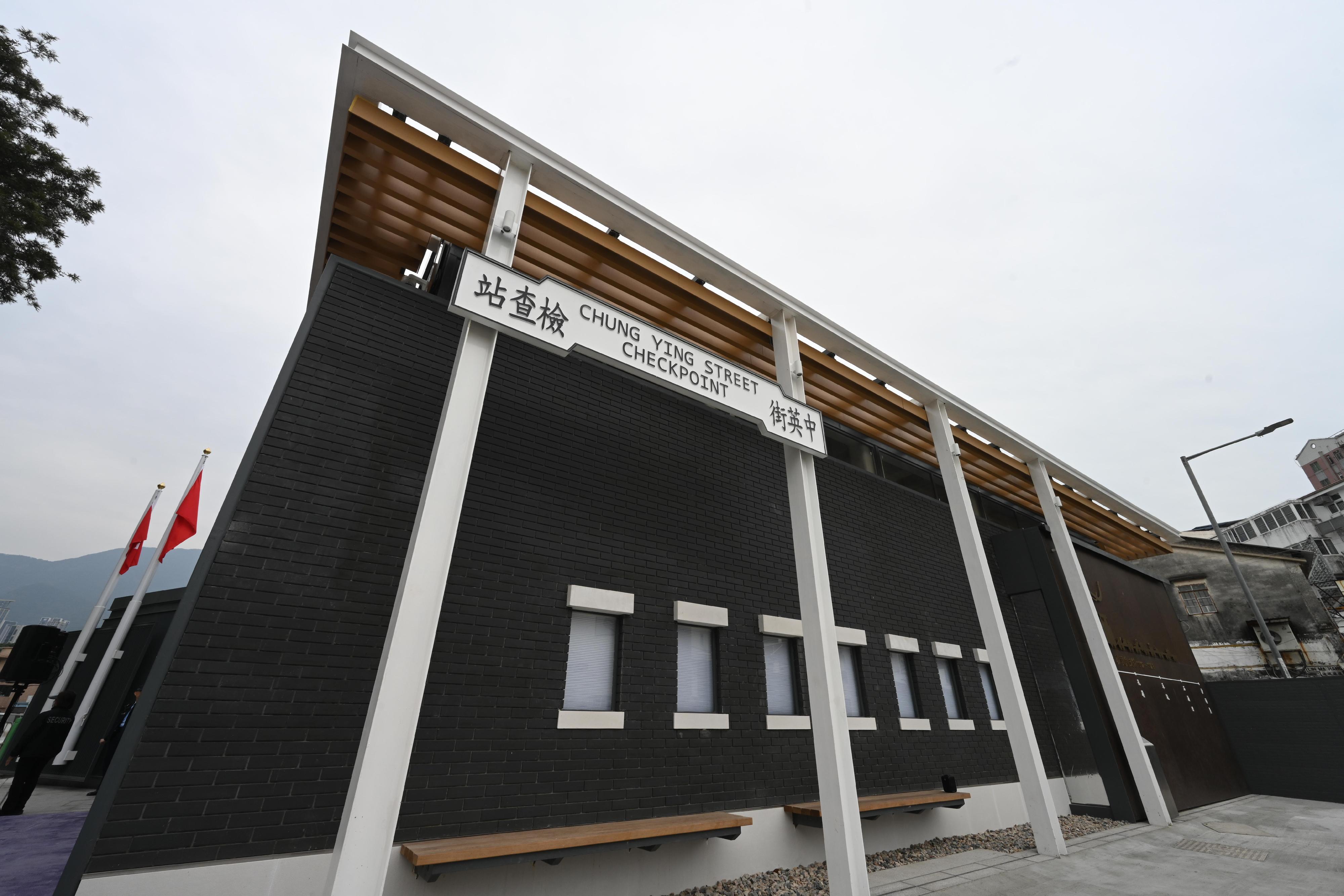

Opening ceremony of reprovisioned Chung Ying Street Checkpoint in Sha Tau Kok held today (with photos/video)

The opening ceremony of the reprovisioned Chung Ying Street Checkpoint in Sha Tau Kok was held today (December 23). A pilot scheme for facial recognition technology has been introduced at the new checkpoint, allowing people living or working at Chung Ying Street to access the area unimpeded through “contactless channels” without having to stop and produce their Closed Area Permit (CAP) or use their fingerprint to verify their identity. The aim is to facilitate the flow of people and enhance the checkpoint’s processing capacity.

Addressing the opening ceremony, the Chief Secretary for Administration, Mr Chan Kwok-ki, noted that to facilitate entry to and exit from Chung Ying Street, the Government has replaced the former checkpoint made up of marquees with a permanent structure, and for the first time introduced facial recognition technology. This allows people living and working on Chung Ying Street to be the first to use “contactless channels” for unimpeded access. The Government will continue to explore the application of relevant technology to complement the future opening of Chung Ying Street for tourism. In the future, holders of valid CAPs for access to Chung Ying Street may, upon prior enrolment, pass through the checkpoint via “contactless channels”. In adopting the pilot scheme, the Government hopes to replace the current mode of manual inspections through applying innovative technology to assist users of the checkpoint, enhance the checkpoint’s capacity, and highlight Hong Kong’s high-quality digital technology as an international metropolis.

Mr Chan also expressed his gratitude to the various government departments and organisations for their joint efforts in the successful completion of the reprovision project, thereby providing better facilities for Chung Ying Street, an area rich in unique historical and cultural value.

The checkpoint’s design has integrated historical and modern elements, showcasing the characteristics of Hong Kong’s traditional train stations. Its exterior wall is decorated with copper plate engravings featuring a historical train, preserving the history of the branch line. In addition, multiple energy-saving designs have been incorporated in the checkpoint which combines functionality and aesthetics, creating a cultural landmark for Chung Ying Street.

​Other officiating guests included the Secretary for Security, Mr Tang Ping-keung; the Permanent Secretary for Security, Mr Patrick Li; the Commissioner of Customs and Excise, Ms Louise Ho; the Director of Immigration, Mr Kwok Joon-fung; the Deputy Commissioner of Police (Operations), Mr Chow Yat-ming; the Deputy Director of Architectural Services, Mr Alan Sin; the Chairman of the New Territories Heung Yee Kuk, Mr Kenneth Lau; and the Chairman of the Sha Tau Kok District Rural Committee, Mr Lee Koon-hung.