The Chief Executive, Mrs Carrie Lam, continued her visit to Belgium today (June 15, Brussels time).

In the morning, Mrs Lam met with the President of the European Commission, Mr Jean-Claude Juncker. She said that the economic outlook of Hong Kong is positive with unemployment rate falling to a 20-year low and that the national Belt and Road Initiative and the Guangdong-Hong Kong-Macao Bay Area development are set to inject new impetus to the city's economy. Noting that Hong Kong, which has been a staunch supporter of free trade, signed a Free Trade Agreement and a related Investment Agreement with the Association of the Southeast Asian Nations last year, she hoped to commence relevant discussion with the European Union (EU). She also hoped that youth exchanges with EU countries can be enhanced, including the launch of more working holiday schemes.

Mrs Lam then visited the Belgian Parliament which has a history of more than 200 years and met with the President of the Chamber of Representatives, Mr Siegfried Bracke. She introduced to him Hong Kong's latest situation, including the successful implementation of "One Country, Two Systems", the independent judiciary, new initiatives rolled out by the new term Government to enhance competitiveness of the city, etc.

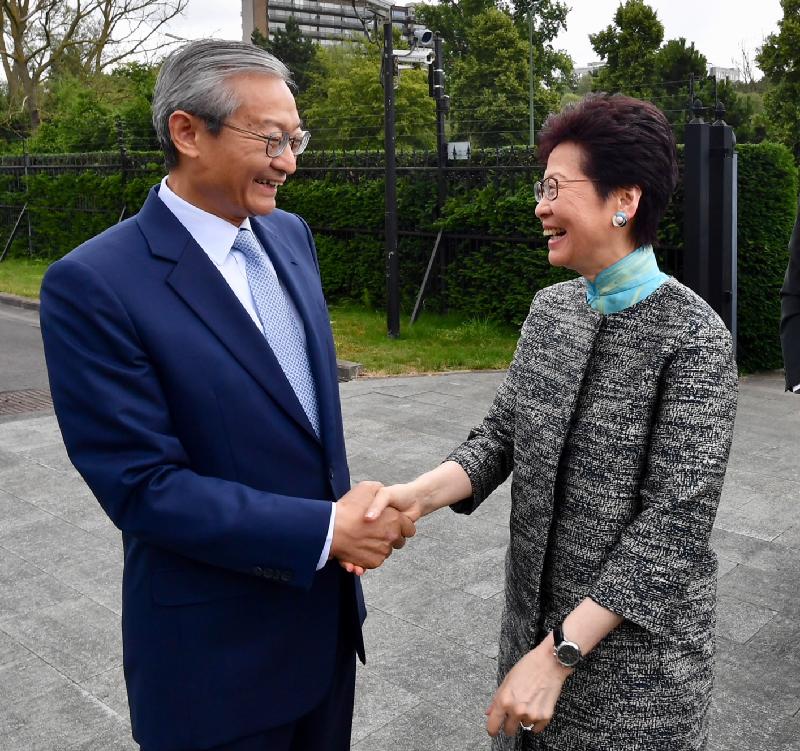

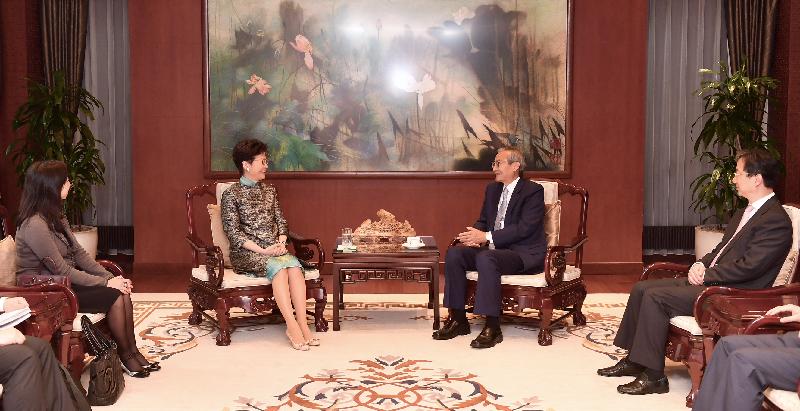

Mrs Lam also attended a lunch hosted by the Ambassador Extraordinary and Plenipotentiary and Head of the Chinese Mission to the EU, Mr Zhang Ming and knew from him the latest development of the bilateral relations between China and the EU. She thanked the Mission for its support for various exchanges between Hong Kong and the EU, and its help with the expansion of the Hong Kong Special Administrative Region Government's external relations.

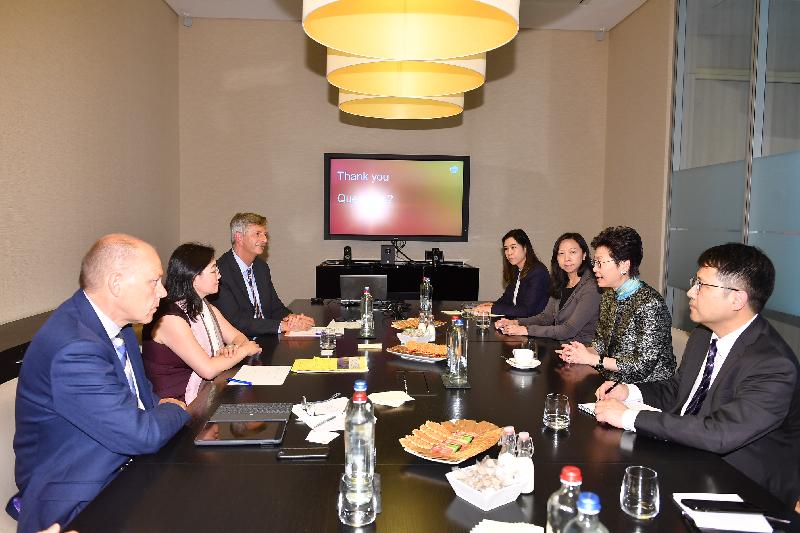

In the afternoon, Mrs Lam visited the GSK Vaccines' headquarters and received a briefing on the company's research and development operation as well as their experience of carrying out clinical trials in Hong Kong.

Mrs Lam headed to Bordeaux in the evening and will start her visit to France tomorrow (June 16, Bordeaux time).