France: EIB approves 600 million euros in financing for Valeo's research projects related to technologies designed to reduce CO2 emissions and improve active safety

- The EIB has approved a 600 million euro financing package to fund Valeo’s research and development projects in Europe, mainly in France

- An initial loan of 300 million euros has just been signed

- The financing will enable the automotive supplier to consolidate its technological leadership in electrification and driving assistance systems

The European Investment Bank (EIB) has approved a 600 million euro package for automotive supplier Valeo to finance its research projects focused on reducing CO2 emissions and improving vehicle safety. The funds are to be allocated to Valeo’s Europe-based research projects, primarily in France, but also in Germany, the Czech Republic and Ireland.

The financing package from the EIB, the European Union’s climate bank, underlines its commitment to supporting research and innovation, as well as the transition to a low-carbon, environmentally friendly economy. It has been granted to Valeo on attractive terms. An initial loan of 300 million euros has just been signed.

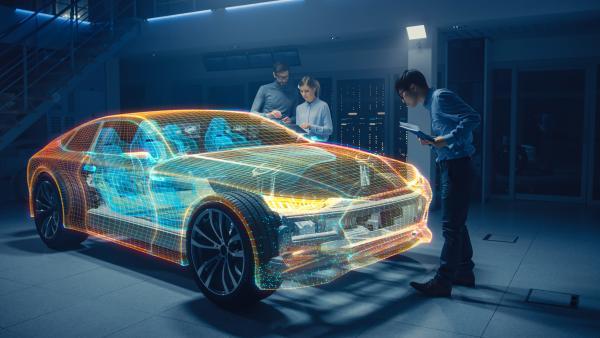

The loan, set to be paid out by May 2022, will be dedicated to research projects in the areas of electrification and the improvement of vehicle energy efficiency (48V systems, battery cooling systems, energy-efficient thermal comfort systems, etc.), as well as safety improvement (driving assistance and autonomous driving systems, smart lighting and wiper systems, etc.), areas in which market demand and Valeo’s growth potential are strongest.

Valeo’s investments in these projects will amount to more than 1.4 billion euros over a four-year period.

In 2019, 57% of Valeo’s original equipment sales were generated by technologies that reduce CO2 emissions and 36% by technologies that improve active safety. As a high-tech company, Valeo has placed innovation at the heart of its strategy. In 2019, nearly half (47%) of orders booked by Valeo concerned innovations that did not exist three years ago.

Valeo recently announced its commitment to achieve carbon neutrality by 2050 across its entire value chain – which includes its suppliers, its own operating activities and the end use of its products – and reach 45% of this objective by 2030.

The European Investment Bank is a long-term partner of Valeo’s. In 2009, the EIB granted it 300 million euros to finance its research into technologies designed to reduce carbon emissions and improve active vehicle safety.

Ambroise Fayolle, Vice-President of the EIB, commented: “The EIB’s support for Valeo’s research and development programs is central to its mission to support investment in innovation. Mastering these new technologies is of crucial importance for Europe in enabling industry to successfully transition to a new, low-carbon and more environmentally friendly model.”

Jacques Aschenbroich, Valeo’s Chairman and Chief Executive Officer explained: “This financing is extremely important, particularly given the profound transformation taking place in the automotive industry. It will enable us to continue our research efforts and strengthen our technological leadership in the key areas of reducing CO2 emissions and improving road safety.”

About Valeo:

Valeo is an automotive supplier, partner to all automakers worldwide. As a technology company, Valeo proposes innovative products and systems that contribute to the reduction of CO2 emissions and the improvement of road safety. In 2019, the Group generated sales of €19.5 billion and invested 13% of its original equipment sales in Research and Development. At December 31, 2020, Valeo had 191 plants, 20 research centers, 39 development centers and 15 distribution platforms, and employed 114,700 people in 33 countries worldwide. Valeo is listed on the Paris Stock Exchange.