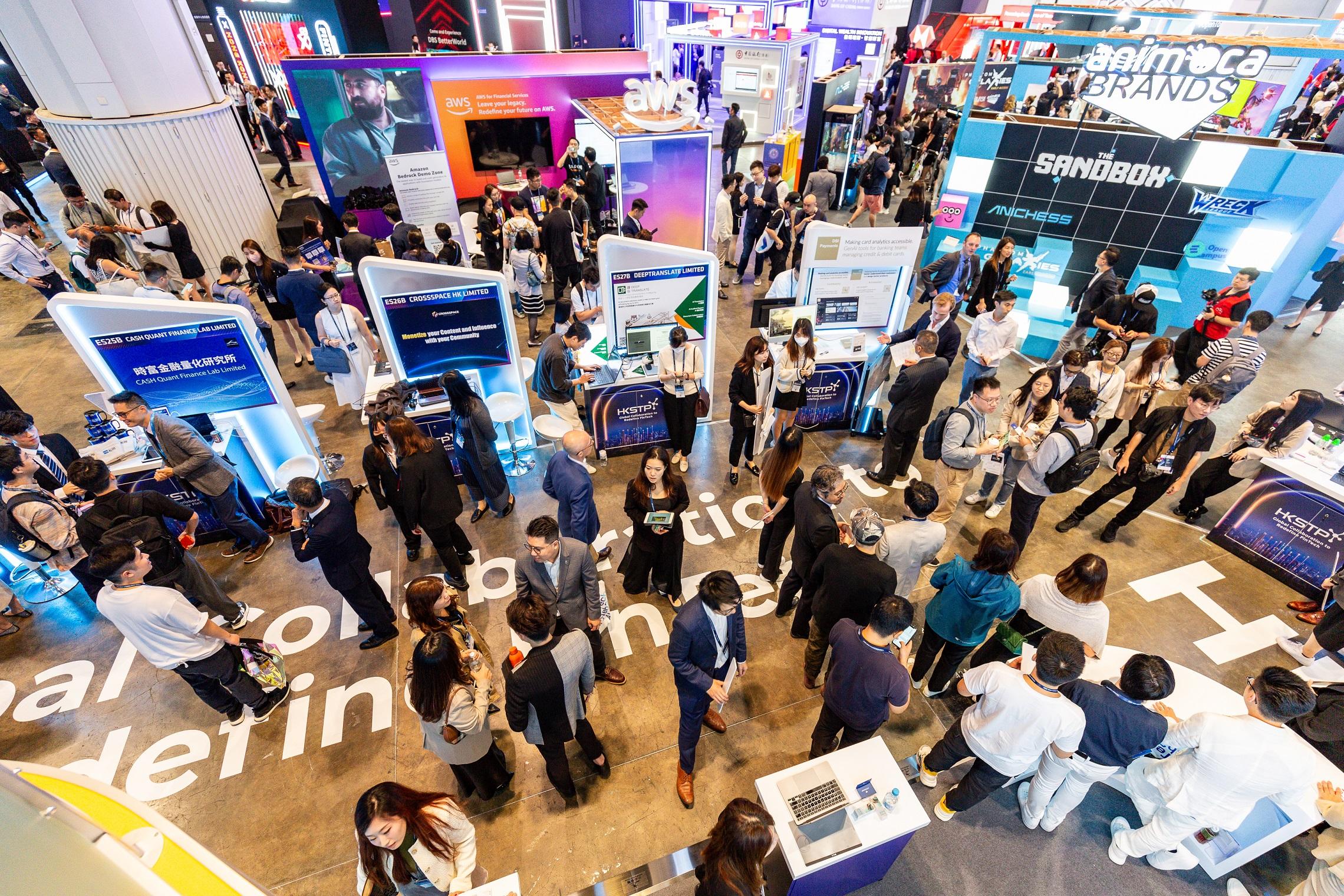

Hong Kong FinTech Week (HKFW) 2023 concluded on November 5, capping off a week-long feast of fintech that included the Greater Bay Area (GBA) Day on October 31 and the two-day main conference on November 2 and 3, where fintech leaders, regulators, and innovators around the world gathered to discuss the rapid fintech industry evolution in Hong Kong and across the region, as well as highlighting the resulting transformation impact on the real economy.

The entire week attracted a record high of over 35 000 attendees and over 5.5 million views online from over 100 economies, featured over 800 distinguished speakers and over 700 exhibitors, as well as attracting more than 30 Mainland and international delegations. The annual flagship event was organised by the Financial Services and the Treasury Bureau (FSTB) and Invest Hong Kong (InvestHK), and co-organised by the Hong Kong Monetary Authority (HKMA), the Securities and Futures Commission (SFC) and the Insurance Authority (IA).

Under the theme "Fintech Redefined.", this year's main conference explored fintech development across six key themes – global regulations and trends such as sustainable and green finance; funding and venture capital as well as family office investments; exploring the realms of artificial intelligence (AI), Web3 and emerging frontiers; fintech innovation in the dynamic Greater Bay Area; Hong Kong's innovation journey; and business showcases.

Hong Kong and Mainland China leaders talk transforming real economy

The Chief Executive, Mr John Lee, opened HKFW 2023 by emphasising Hong Kong's ideal environment for developing fintech. "No other economy can claim our unique advantage under the 'one country, two systems' principle – which has empowered us to draw on, and create, opportunities from both our country and the world at large," he said. He also added that the city's efforts in financial innovation and industry regulation will help shape the future of fintech in every dimension.

The Financial Secretary, Mr Paul Chan, shared how fintech brings about real impact and tangible benefits to people's lives. "Fintech is not just financial technology's portmanteau. It is also a catalyst for driving change and innovation, for making financial services more accessible, inclusive, efficient and user-friendly," said Mr Chan. Mr Chan also remarked that Hong Kong has a vibrant fintech ecosystem, and Government and regulators have been driving various new initiatives to spur fintech development.

Deputy Governor of the People's Bank of China Mr Zhang Qingsong delivered a keynote speech that emphasised how fintech in Mainland China is empowering inclusive finance. "The Greater Bay Area, as one of the most open, dynamic, and competitive world-class city clusters, is well-positioned for developing fintech and inclusive finance," said Mr Zhang.

HKFW: Fintech redefined in action

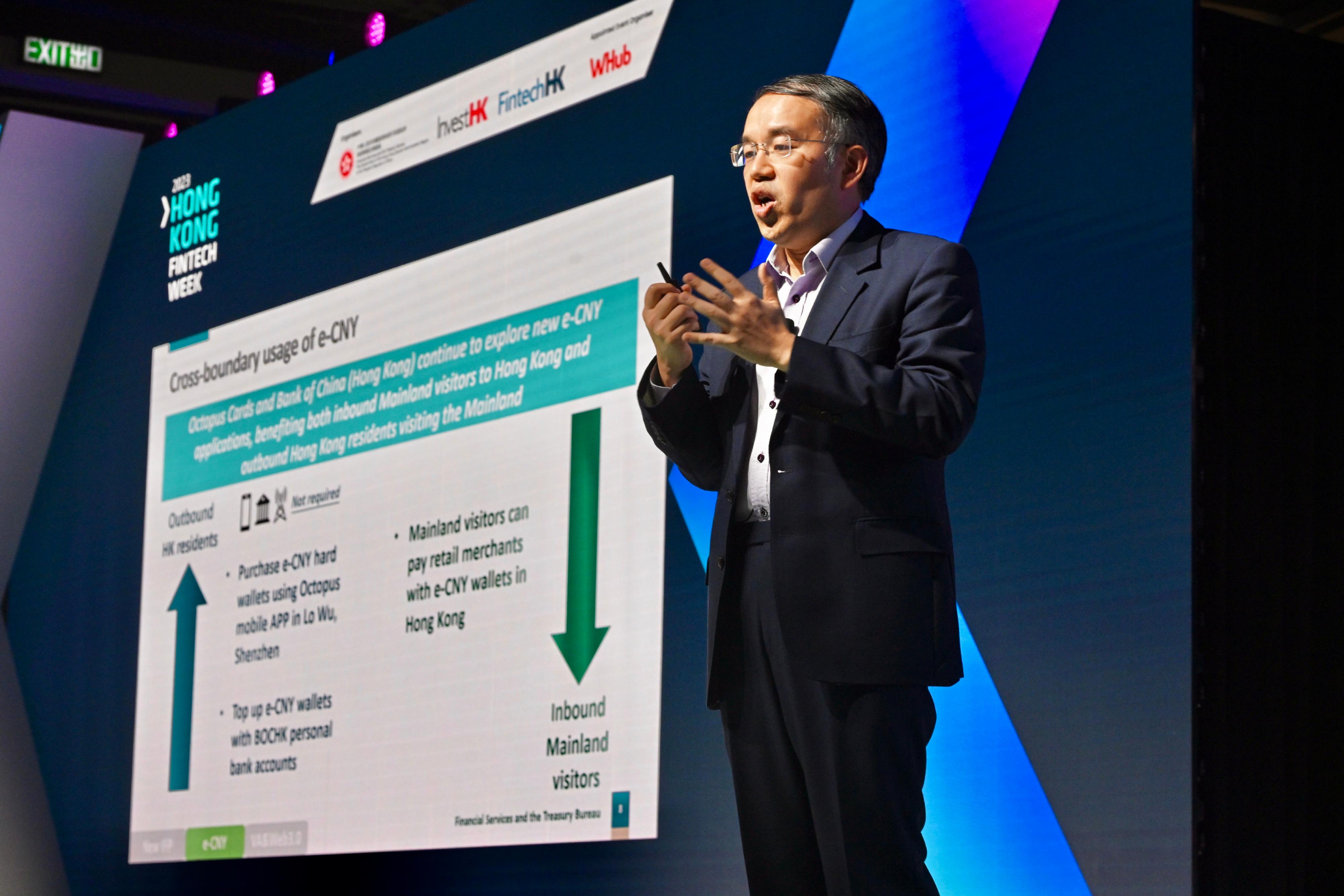

The Secretary for Financial Services and the Treasury, Mr Christopher Hui, announced three major initiatives to foster co-development of fintech and real economy at the Main Conference of the FinTech Week on November 2. These include launching a new Integrated Fund Platform, welcoming cross-boundary e-CNY applications to benefit inbound and outbound visitors between the Mainland and Hong Kong, and promoting real economy-related applications and innovations by the Virtual Assets and Web3.0 sector, as well as further development of the regulatory framework. "The Government will join hands with regulators and major market players to press ahead with the initiatives, with a view to injecting new energy to our ever-growing fintech ecosystem," he said.

The Chief Executive of the HKMA, Mr Eddie Yue, announced Phase 2 of the e-HKD Pilot Programme, which the HKMA intends to commence next year. It will explore new use cases for an e-HKD and delve deeper into select pilots from Phase 1.

Echoing the theme of central bank collaboration, Mr Yue also announced that the HKMA is working closely with the Bank of Thailand to link Hong Kong's Faster Payment System (FPS) and Thailand's PromptPay in a new service called FPS x PromptPay QR Payment, scheduled for launch on December 4. Hong Kong's FPS users will be able to scan and pay at over 8 million PromptPay merchants in Thailand using their mobile phones. The HKMA is also in discussions with market participants to explore further use cases for distributed ledger technology in capital markets, including a second tokenised government green bond.

The Chief Executive Officer of the SFC, Ms Julia Leung, observed how Web3 was emerging in Hong Kong but stressed that more time would be needed to fully build up the ecosystem. She added that the SFC fully supports continued experimentation with tokenisation in the financial markets, but risks arising from the use of new technology should be managed. In this connection, the SFC has issued two recent circulars to provide guidance to intermediaries issuing or distributing tokenised securities and SFC-authorised investment products.

The insurance sector also chimed in by highlighting major opportunities for fintech to positively impact the industry. The Chief Executive Officer of the IA, Mr Clement Cheung, observed two prominent protection gaps for the insurance sector to address: cyber-resilience and climate change.

The Secretary for Innovation, Technology and Industry, Professor Sun Dong, noted that Hong Kong's fintech mission is gathering pace with the backing of the city's thriving innovation and technology ecosystem that is growing in strength. He also highlighted the HKMA's Commercial Data Interchange, the development of the Government's Consented Data Interchange Gateway and the continued enhancement of the iAM Smart platform as major enablers of fintech innovation.

The city's impressive fintech ecosystem development and opportunities ahead were also lauded by the Acting Secretary for Commerce and Economic Development, Dr Bernard Chan. He pointed out that the Government would launch new measures to promote the development of e-commerce, which could also facilitate the wider application of fintech.

Transformation agents: virtual assets, web3 and AI

A special session on the "1st Anniversary of Digital Assets Policy Announcement" highlighted InvestHK's continued ambitions to develop transformative Web3 applications. The Acting Director-General of Investment Promotion of InvestHK, Dr Jimmy Chiang, shared specific Web3 successes that showcase the benefits to the economy and the lives of Hong Kong people while also bringing global impact. One example is HashKey Group and Arkreen launching the Web3 Decentralised Physical Infrastructure Networks (DePIN) Hong Kong initiative globally at the 2023 Hong Kong Web3 Carnival in April. DePIN is leading the charge, leveraging Web3's economic incentive model and smart contract collaboration mechanism. Arkreen, like all DePIN networks, is a decentralised energy data infrastructure that forms a closed-loop ecosystem encompassing both the supply and demand sides. On the supply side, Arkreen gathers data on individual environmentally friendly actions, measuring their impact as Proof of Physical Work (PoPW). This data undergoes validation, gets recorded on the blockchain, and establishes a trusted climate action footprint. The PoPW data serves as an endorsement for issuing green certificates and distributing token rewards to contributors for their genuine climate actions.

The Head of Financial Services and Fintech of InvestHK, Mr King Leung, hosted the co-founder of Chainlink, Mr Sergey Nazarov, in a fireside chat to discuss the latest developments in underlying blockchain protocols that support the rapidly developing digital asserts and Web3 landscape. Mr Nazarov observed how Cross-Chain Interoperability Protocol can solve integration issues, "as we cannot afford to have digital islands that are impeding liquidity," he noted.

Another Web3 leading light in Hong Kong, the Co-Founder and Executive Chairman of Animoca Brands, Mr Yat Siu, touted the bright future of Web3 in Hong Kong as "the culture of blockchain is actually very compatible for Hong Kong" due to its protection of property rights, capitalist infrastructure and financial literacy.

HKFW could not take place without in-depth discussion on AI. Renowned global AI guru, Chairman and Chief Executive Officer of Sinovation Ventures and President of Sinovation Ventures Artificial Intelligence Institute, Dr Lee Kai-fu, observed how generative AI technologies like ChatGPT are having a profound impact in a way that past technologies cannot match in terms of speed and scale of development and adoption. "AI will impact every job in every industry. If you are not learning how to use generative AI today, you are at a huge disadvantage to your peers and competitors," he added.

AI's pervasive impact across all sectors, in particular in the worlds of fintech and finance, would continue to pull huge investments, noted the Chief Executive Officer and Managing Director of General Catalyst, Mr Hemant Taneja, and the Global Partner of Fosun, Co-Chairman of the board and Chief Executive Officer of Fosun Capital, Mr Mike Xu. Both noted how investment bubbles are good for intergenerational technologies like AI, as overinvestment will help to realise the full potential of AI. Xu enthused how AI is becoming an everyday assistant that will significantly improve productivity, "so that we can all become CEOs."

Global Scaleup pitching winner

The final day of Hong Kong FinTech Week 2023 saw industry leaders turn judges as they announced the grand winner of the Global Fast Track's Global Scaleup Competition 2023.

The annual flagship Global Fast Track brings together global innovative fintech companies that already have commercial customers in their home market and beyond to showcase their business solutions and connect with regional corporates and investors. Over 500 competitors from over 63 markets around the world, pitched their ideas across the fintech, AI and Web3 categories. The grand winner was Libertify, a France-based personalised AI risk management solution provider that beat 12 other global finalists bidding to be crowned the grand champion. The competition prizes included potential equity investment of up to US$3,000,000 as well as mentorship opportunities with the Accenture Fintech Innovation Lab and market access opportunities with the Hong Kong Science Park Market Discovery Programme.

Further information can be found at www.fintechweek.hk/, or by following the official social media accounts:

LinkedIn: Hong Kong Fintech Week

Selected session replays on YouTube: www.youtube.com/c/HongKongFinTechWeek

About Hong Kong FinTech Week

Hong Kong FinTech Week 2023, organised by the FSTB and InvestHK, and co-organised by the HKMA, the SFC and the IA, is Asia's global financial technology event for scaling new heights. The entire week attracted over 35 000 attendees and over 5.5 million views online from over 100 economies, featured over 800 distinguished speakers and over 700 exhibitors, as well as attracting more than 30 Mainland and international delegations. The week-long event featured multitrack conferences with prominent speakers, exhibitions, a deal floor, workshops, networking and satellite events, demo sessions and metaverse experiences.

About InvestHK

InvestHK is the department of the Hong Kong Special Administrative Region Government responsible for attracting foreign direct investment. It has set up a dedicated fintech team in Hong Kong to attract the world's top innovative fintech enterprises, start-up entrepreneurs, investors, and other stakeholders to set up and scale their business via Hong Kong into Mainland China, Asia, and beyond. For more information, please visit www.hongkong-fintech.hk.

Follow this news feed: East Asia